摘要

日本 NISA 個人免稅投資 2024 新制登場,包括資本利得、股利永久免稅、提高投資額度、降低投資年齡,有利於擴大投資意願、引導日圓流入股市。建議定期定額投資瀚亞投資-日本動力股票基金研究團隊給出答案!看好日股結構性利好因子將延續發酵,加上股票回購、加薪抵銷通膨、股票評價未過熱等優勢,日股 2024 年將不只是延續漲勢,反倒可能進入牛市的多頭融漲(melt up)階段。

日本在 2023 年受到物價上漲、薪資上漲和日圓疲軟的推動,日本股市在 2023 年異常強勁。2024 開年以來,日股也沒讓投資人失望,日經 225 指數站上 36,000 點、東證指數超過 2,500 點水位,成為全球股市亮點。

瀚亞投資-日本動力股票基金研究團隊最新觀點:

Q1. 全球經濟正在放緩,2024年出口需求可能略顯疲軟,日股如何獨善其身?

2024 年支撐日股上漲的三個結構性順風因素,仍然存在:

(1)從通貨緊縮轉向通貨膨脹

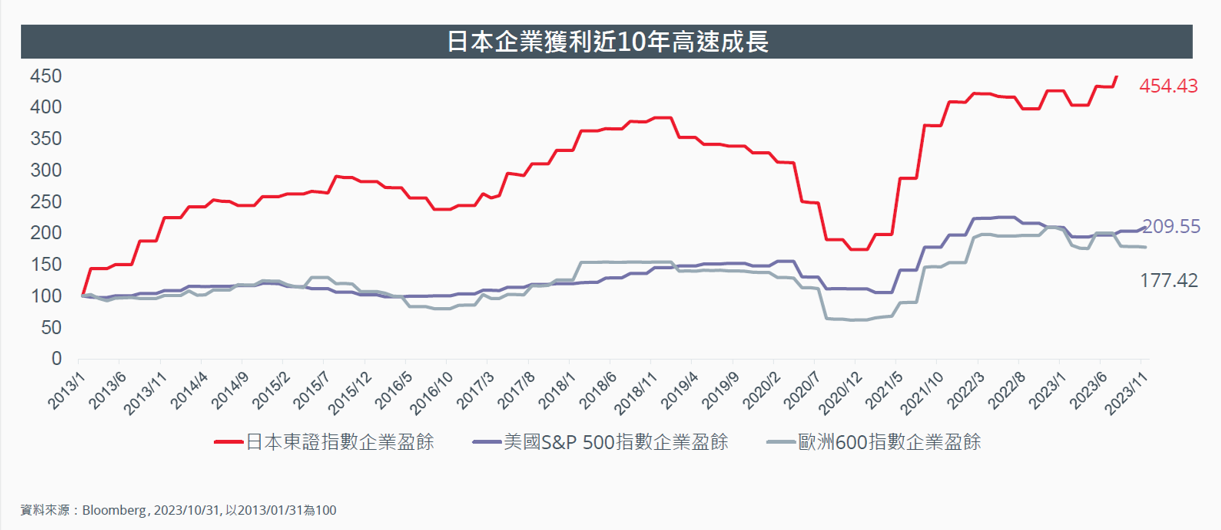

(2)透過公司治理改革,提高企業獲利能力

(3)更強勁的資本支出環境

日本的國內需求看起來仍相當不錯,投資勢頭也逐步增強中。我們預計今年日本企業將持續發布有關提高獲利能力與合理化資產負債表的舉措,在東京證券交易所推動下,持續改善公司治理。儘管股票回購很重要,但「真正的業務重組」才是能在未來數年間改變價格評價的真正因素。

圖、日本企業獲利持續高速成長,優於歐洲與美國

Q2. 通膨對日本來說是阻力還是助力?

隨著成本推動的通膨緩解、以及第一季年度春鬥(Shunto)談判取得良好結果,實質薪資可望在 2024 年轉向正面發展。儘管日圓走強對一些公司來說可能是個阻力,但一般來說,我們預期價格和獲利的成長能夠抵銷這種影響。

Q3. 日股股價已經反映了哪些利多因素?還有繼續上漲空間嗎?

經歷 2023 年上漲,但日本股票價格評價仍處於長期區間的中位,評價尚未過高,與其他已開發市場相比起來很有吸引力。海外投資人對日本的配置比重仍屬「低配」,持續上升的通膨和新推出的 NISA(日本個人儲蓄帳戶) 計畫可能會刺激國內投資人 2024 年重返股市。

結論

日本股市不論在宏觀和微觀等層面上,都具備強而有力的支撐;持續的結構性變化使日本成為全球表現最突出的市場。2024 年起,更重要的可能是擁有「對」的股票,而不是由上而下的題材。日本股市的「價值重估(re-rate)行情」應可得以持續。一切都已準備就緒,日本股市應可持續多頭融漲(melt-up),行情上漲可期,建議投資人長期配置,透過定期定額投資方式布局日股。

Singapore and Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws.

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (531241-U).

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

United Kingdom (for professional clients only) by Eastspring Investments (Luxembourg) S.A. - UK Branch, 10 Lower Thames Street, London EC3R 6AF.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author on this page, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this posting is at the sole discretion of the reader. Please consult your own professional adviser before investing.

Investment involves risk. Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments (excluding JV companies) companies are ultimately wholly-owned/indirect subsidiaries/associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company, a subsidiary of M&G plc (a company incorporated in the United Kingdom).