摘要

印度最新公布季度 GDP 超乎市場預期,再次驗證當地經濟快速發展實力。瀚亞投信表示,印度受惠於強勁的經濟成長與地緣政治改善,印度股市持續走強,今年更搭上總理大選題材,資金提前卡位,推升印度股票漲勢。

印度指數衝高 可續抱具長線題材的產業

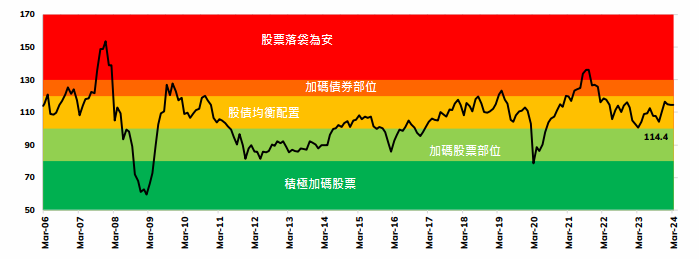

根據瀚亞投資-印度溫度計最新指標顯示,2024 年 3 月維持在 114.4,處「股債均衡配置區」,隨著股市評價上升,指標也逼近「加碼債券部位區」,當前投資人應合理均衡分配印度股票及債券的持有部位。

ICICI 保誠資產管理表示,雖然印度經濟成長表現強勁,但股票估值已來到不便宜水位,但部分產業仍具投資價值,持續看好汽車、原物料及通訊等,以及部份的必須消費品、金融及保險等,皆具投資吸引力。

利空因素消弭,使印度股票漲勢凌厲。ICICI保誠資產管理表示,對現在持有印度股票持有者,建議可繼續持有較長線成長題材的產業;而對現在想要進場的投資人,得有居高思危的心態,建議可在市值與產業間進行較靈活的操作策略。

印度總理大選前 資金湧入股市卡位

瀚亞印度基金經理人林庭樟表示,印度總理大選結果預計在 6 月出爐,執政黨莫迪政府連任機會較高,市場樂觀看待當地經濟政策得以延續,促使全球資金提前湧入印度股票卡位,迎選後行情;根據歷史經驗,印度總理大選行情有機會延續到選後,若再搭配印度強勁與快速成長的經濟數據,預料今年印度股票選後的上漲行情仍值得期待。

林庭樟表示,印度在疫情之後迅速復甦,各產業如原先預期,工業化、城鎮化、消費與產業升級等都只是在疫情期間受到遞延,目前都已經回到原先軌道,並朝不可逆的進程邁進,這也促使印度與中國兩大股票市場間的相關性愈來愈低。

林庭樟說,印度在實際 GDP 成長持續強勁、優化的貿易條件、靈活的通貨膨脹目標及穩定的非投資組合外匯流動將持續帶來強勁的經濟發展穩定性;由於印度經濟成長故事仍持續當中,建議投資人可把握走勢波動拉回機會進行加碼,或是定期定額介入印度基金,以參與印度經濟發展故事。

圖、印度溫度計分數:114.4

資料來源:ICICI RUDENTIAL, 2024/3印度股債評價指數之評價模型是根據本益比、股價淨值比、政府債收益率以及市值佔 GDP 比重等參數綜合評估。指標僅供參考之用,請勿視為基金買賣之邀約或其他任何投資之建議 。ICICI 保誠資產管理公司是由印度當地最大民營銀行 ICICI Bank 及保誠集團(Prudential plc)共同成立之資產管理公司,目前固定收益資產管理金額為全印度最大。

★ 瀚亞印度溫度計指數是根據印度市場中多項投資指標設立評價模型,並依據最終數據劃將投資建議分為「積極加碼股票、加碼股票部位、股債均衡配置、加碼債券部位,跟股票落袋為安」等區間。

Singapore and Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws.

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (531241-U).

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

United Kingdom (for professional clients only) by Eastspring Investments (Luxembourg) S.A. - UK Branch, 10 Lower Thames Street, London EC3R 6AF.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author on this page, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this posting is at the sole discretion of the reader. Please consult your own professional adviser before investing.

Investment involves risk. Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments (excluding JV companies) companies are ultimately wholly-owned/indirect subsidiaries/associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company, a subsidiary of M&G plc (a company incorporated in the United Kingdom).